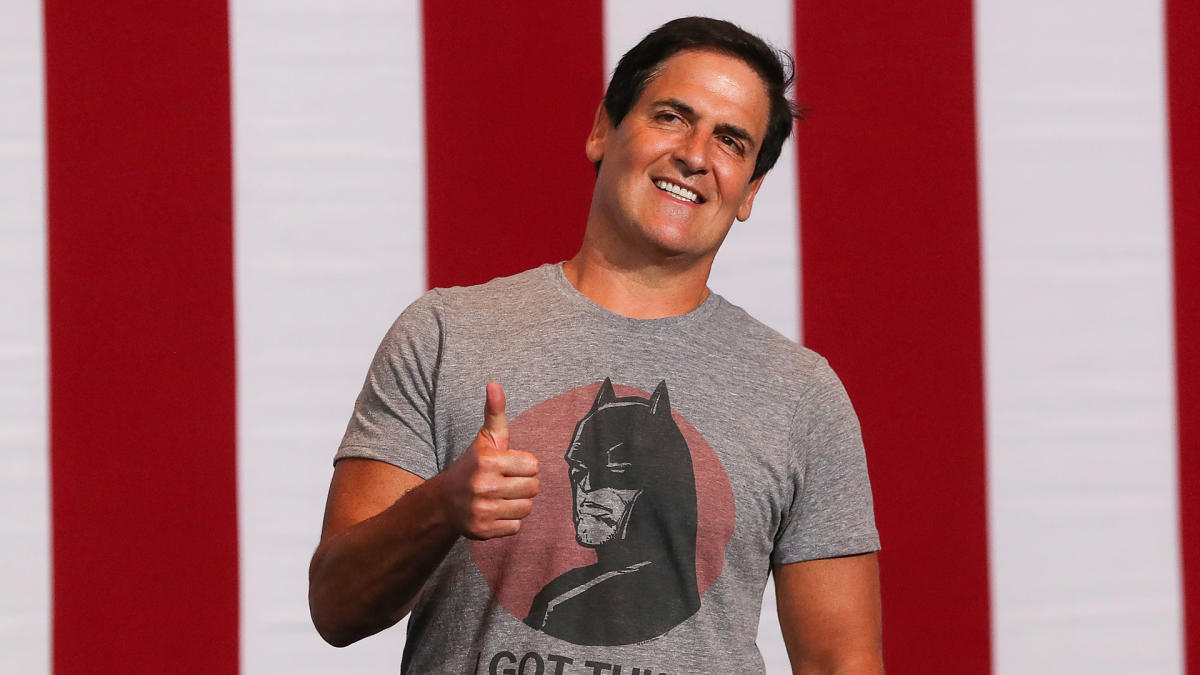

Investment Strategies of Mark Cuban: Diversification, Dividend Stocks, AI Companies, Cryptocurrency, and More

Mark Cuban, the outspoken billionaire and investor, is known for his unconventional views on finance and investing. He believes in taking risks and investing in opportunities that others may overlook. Cuban’s investment strategy is a mix of aggressive and passive income-generating assets, all aimed at maximizing returns and building wealth over time.

One of Cuban’s favorite investment options is dividend-paying stocks. He believes that these stocks provide real-world value by generating passive income right away. Unlike non-dividend stocks, which rely on market metrics for value, dividend-paying stocks offer a steady income stream through quarterly dividends, even when the markets are down.

Another area where Cuban sees potential is in AI companies. While he typically avoids owning individual stocks, Cuban makes an exception for companies involved in artificial intelligence. He believes that AI is the future and that every company will need it to thrive. By investing in AI-related stocks, Cuban hopes to capitalize on the potential growth and value of these companies over time.

Cryptocurrency is another area where Cuban sees opportunity, albeit with caution. He acknowledges the speculative nature of cryptocurrencies but believes in the underlying technology and its potential for universal utility. Cuban advises investors to only put money they can afford to lose into crypto, as it is a high-risk, high-reward investment.

In addition to stocks and cryptocurrencies, Cuban also invests in the S&P 500 index, a low-cost, passive investment option that has historically provided a solid return over time. He also invests in private companies, leveraging his position on “Shark Tank” to access high-risk, high-reward opportunities that may generate income in the long run.

Overall, Cuban’s investment strategy is a mix of aggressive and passive income-generating assets, all aimed at maximizing returns and building wealth over time. While his approach may not be suitable for everyone, Cuban’s success as a self-made billionaire speaks to the effectiveness of his investment philosophy.