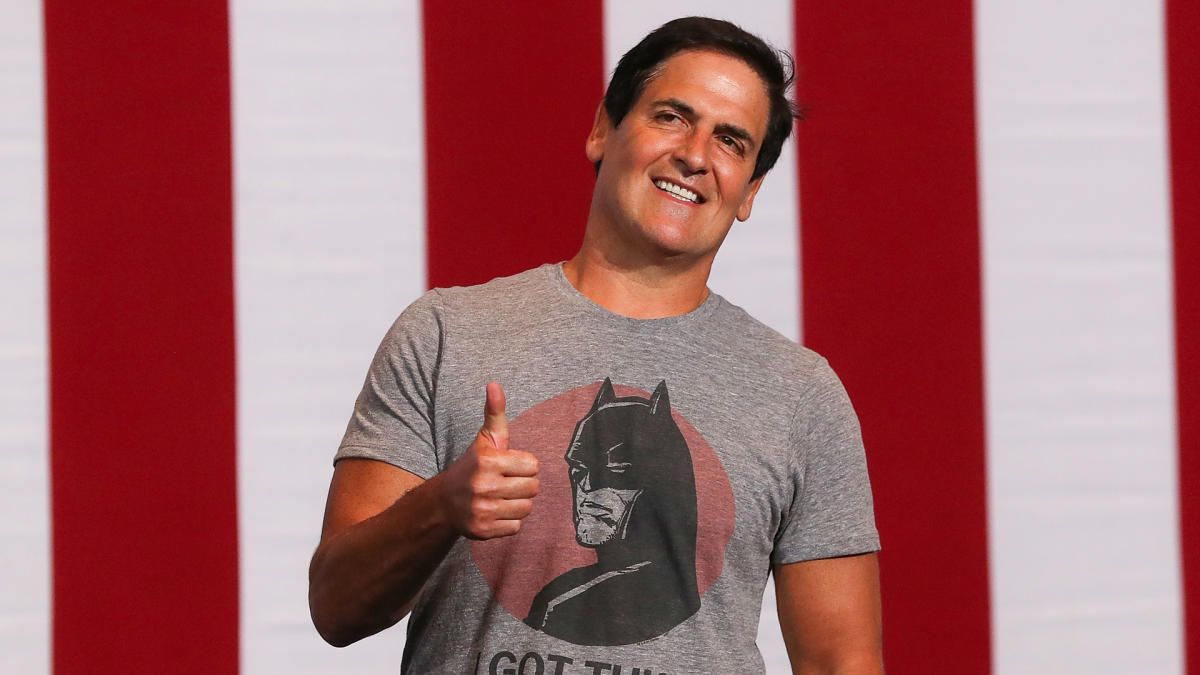

Investment Tips from Mark Cuban: How to Generate Passive Income

Mark Cuban, the outspoken billionaire and investor, is known for his unconventional views on finance and investing. Taking a page from Warren Buffett’s playbook, Cuban believes in making bold investment choices that can lead to significant wealth if done correctly.

One of Cuban’s key strategies is investing in dividend-paying stocks. According to Cuban, these stocks provide real-world value by generating passive income through regular dividend payments. This strategy allows investors to earn income even when the markets are down, providing a steady stream of cash flow.

In addition to dividend-paying stocks, Cuban also sees potential in AI companies. While he typically avoids individual stocks, Cuban believes that AI-related companies have a bright future and can provide significant returns for investors. By investing in companies that are at the forefront of AI technology, Cuban aims to capitalize on the growing importance of artificial intelligence in various industries.

Cryptocurrency is another area where Cuban sees potential for significant returns. While he acknowledges the high risk associated with cryptocurrencies, Cuban believes in the underlying technology of smart contracts and the universal utility they can provide. By investing in cryptocurrencies like Bitcoin and Ethereum, Cuban takes a calculated risk in the hopes of achieving substantial gains.

Despite his differences with Warren Buffett on the topic of cryptocurrency, both billionaires agree on the value of low-cost S&P 500 index funds for long-term investors. By investing in the index, investors can benefit from the overall growth of the market and achieve passive wealth over time.

Lastly, Cuban also invests in private companies, particularly through his role on “Shark Tank.” While this form of investment carries high risk, it can also lead to high rewards and potentially generate passive income for investors. Cuban’s hands-on approach to investing in private companies sets him apart from traditional passive investors, but the potential for significant returns is enticing.

Overall, Mark Cuban’s investment strategies reflect his willingness to take risks and think outside the box. By diversifying his portfolio with a mix of dividend-paying stocks, AI companies, cryptocurrency, index funds, and private investments, Cuban aims to build wealth and generate passive income over time.