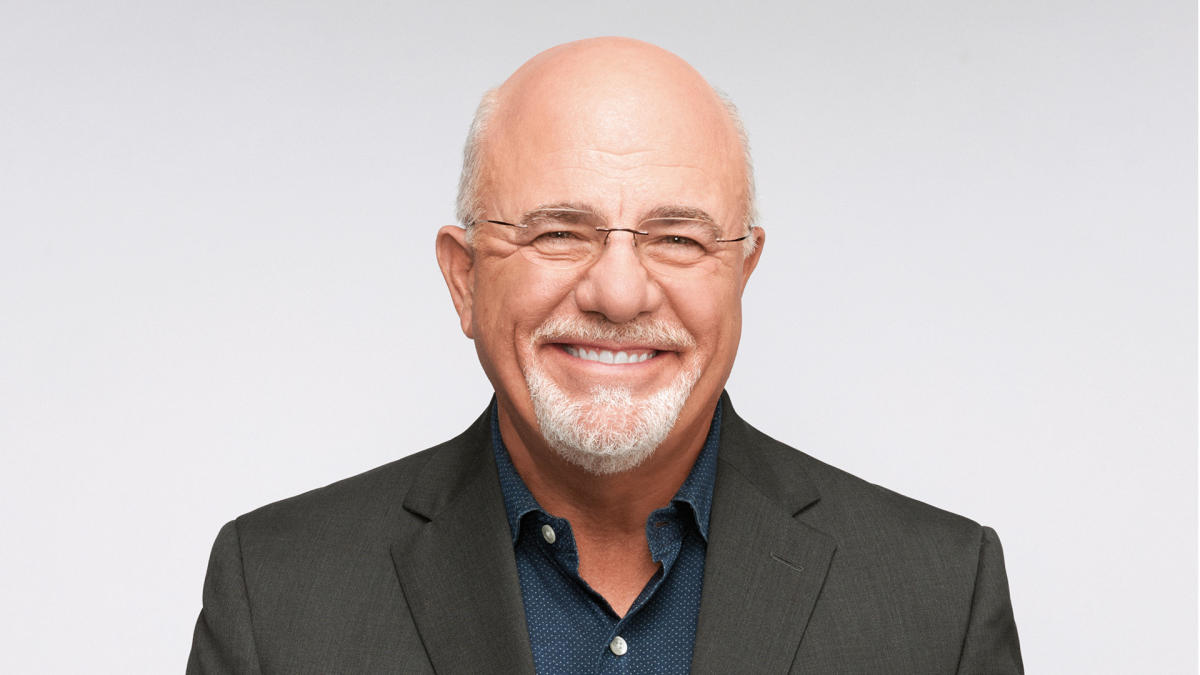

Dave Ramsey’s 9 Steps for Retirement Planning

Dave Ramsey, a well-known personal finance expert and host of “The Ramsey Show,” has outlined nine steps to help Americans secure their finances for retirement. In a recent study, it was found that 20% of Americans over 50 do not have any retirement savings, and more than half are unsure if they will have enough. This highlights the importance of having a solid retirement plan in place.

One key piece of advice from Ramsey is to set clear retirement goals. By determining what you want to do in retirement, whether it’s traveling or spending time with family, you can calculate how much you will need to make those dreams a reality. This will allow you to create a personalized strategy to reach your goals based on your current financial situation.

Ramsey also recommends saving and investing at least 15% of your gross income towards retirement. This can be done through individual retirement funds or a 401(k) plan, which many employers offer. Contributing to a 401(k) not only provides tax advantages but may also come with an employer match, increasing your savings even further.

In addition to saving for retirement, Ramsey emphasizes the importance of getting out of debt, including paying off your mortgage. By using methods like the snowball or avalanche approach to pay down debts, you can free up more money to put towards your retirement savings.

Planning for healthcare expenses and understanding your Social Security options are also crucial steps in securing your financial future. Opening a health savings account and signing up for Medicare can help alleviate the burden of healthcare costs in retirement.

Lastly, Ramsey advises seeking the guidance of a financial advisor to ensure you are on the right track towards a comfortable retirement. By following these steps and staying focused on your long-term goals, you can better prepare yourself for a financially secure retirement.