Exploring the Stability and Growth of Residential REITs for Long-Term Investors

Title: Residential REITs: A Stable and Profitable Investment Option for Long-Term Investors

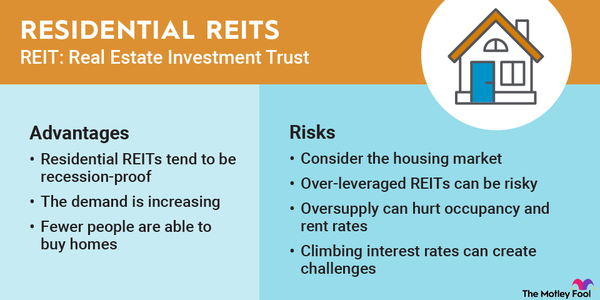

For investors seeking stability and growth in their long-term investments, residential Real Estate Investment Trusts (REITs) offer a reliable option. Unlike the volatility often associated with growth stocks, residential REITs provide a sense of security as they represent tangible real estate assets that society relies on. While not as flashy as other investment options, residential REITs play a crucial role in providing essential housing options for individuals and families.

Understanding Residential REITs

Residential REITs are a popular choice among investors as they focus on acquiring and renting out residential properties. These properties can range from single-family homes to large multifamily complexes, making real estate investing more accessible to a wider range of individuals. By utilizing gross leases, residential REITs generate income through rental payments and property appreciation, aiming to enhance their overall return on investment.

Advantages of Investing in Residential REITs

There are several compelling reasons to consider investing in residential REITs, including their recession-proof nature. Regardless of economic downturns, the demand for housing remains constant, ensuring a steady stream of income for REIT holders. Additionally, the increasing population and a shift towards renting rather than homeownership further boost the rental market, providing opportunities for growth in residential REIT investments.

Risks of Investing in Residential REITs

While residential REITs offer stability, there are risks to consider, such as fluctuations in the housing market and the potential impact of oversupply on occupancy rates and rental income. Additionally, over-leveraging and rising interest rates can pose challenges for REITs, affecting their financial stability and ability to generate returns for investors.

Top Residential REITs to Consider in 2024

For investors looking to capitalize on the residential real estate market, companies like Camden Property Trust, Mid-America Apartment Communities, Inc., and UMH Properties present attractive investment opportunities. These REITs have demonstrated strong performance and strategic positioning within the market, making them favorable choices for long-term investment growth.

Should You Invest in Residential REITs?

Investing in residential REITs offers a hands-off approach to real estate investing, allowing investors to benefit from property appreciation and rental income without the day-to-day management responsibilities. With the stability and growth potential of residential REITs, they can be a valuable addition to a diversified investment portfolio.

In conclusion, residential REITs provide a stable and profitable investment option for investors seeking long-term growth and income. By understanding the advantages and risks associated with these investments, individuals can make informed decisions to enhance their financial portfolios.