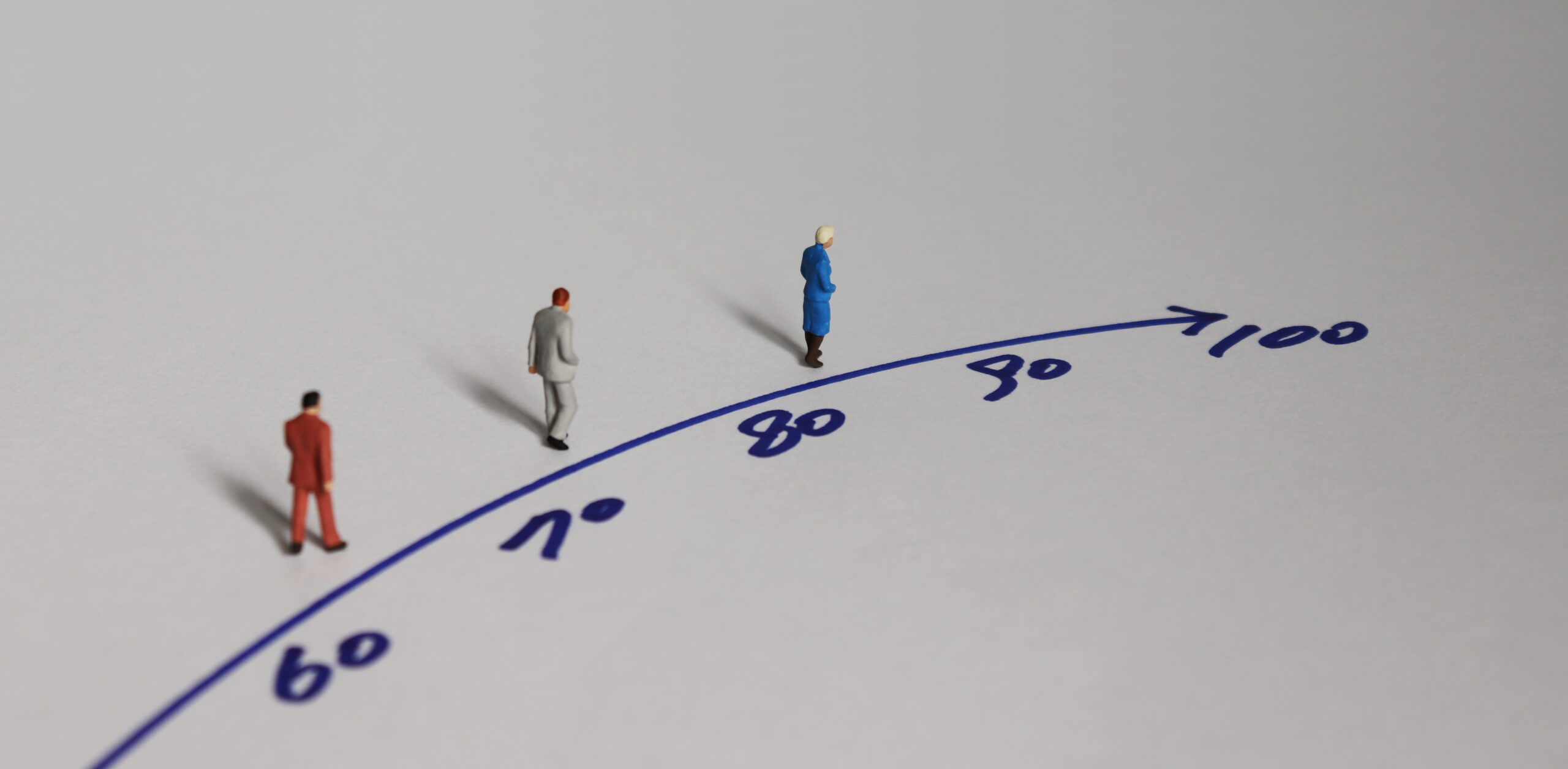

Navigating Longevity Risk: Using Health-Based Actuarial Data for Retirement Planning

Actuarial Data Shows Low Odds of Living to 95 for Retirees with Chronic Health Conditions

A recent study has revealed some startling statistics about the likelihood of retirees reaching the age of 95, especially for those with chronic health conditions. According to the data, only 5% of individuals over the age of 60 without a chronic health condition have a 1 in 5 chance of living to 95. However, for the 30% of retirees with diabetes, the odds of reaching this age are less than 1%.

These findings have raised questions about the commonly used industry “rule of thumb” of planning to age 95 for all clients. Ron Mastrogiovanni, CEO of HealthView Services, emphasizes the importance of incorporating health-based actuarial data into retirement planning discussions with clients. By considering factors such as sex at birth and health conditions, advisors can provide more accurate projections of longevity.

For example, a healthy 65-year-old male is projected to live to 88, while a healthy female is expected to live to 90. However, if the male has high cholesterol, his life expectancy drops to 85, and if he has type 2 diabetes, it further decreases to 78. These numbers highlight the impact of health conditions on longevity and the need for realistic planning.

Mastrogiovanni stresses the importance of discussing both the risks and benefits of longevity planning with clients. While it is essential to address the financial consequences of living longer, it is equally important to consider the possibility of dying earlier than expected. By using health-based actuarial data as a foundation for retirement planning, advisors can help clients make informed decisions about their financial future.

Overall, the study underscores the need for a personalized approach to retirement planning that takes into account individual health factors. By incorporating actuarial longevity projections and considering the potential impact of chronic health conditions, advisors can help clients navigate the complexities of retirement planning and ensure their financial goals align with their health realities.