What’s the Difference between? FICO Score vs. Credit Score, from the recent studies, it has been identified that most of the people tend to get confused in between FICO score and credit score. Both these terms are often used by lenders.

Understanding FICO score

FICO score has been there for quite some time. Due to the same reason, many people assume that it is the same as a credit score. You will be able to find many different credit score types. However, you cannot say that all those credit score types belong to FICO scores.

FICO is one brand of credit score. It was developed by Fair Isaac Corporation in the year 1989. In order to get a better picture of the FICO score, you can assume that your credit scores are equivalent to online stores. You can find numerous online stores, such as Amazon, eBay, Target and AliExpress. Out of them, the FICO score would be equivalent to Amazon. It is the most prominent credit score type that you can find out there in the world.

According to recent studies, it has been identified that 90% of the online lenders prefer to use FICO score in order to move forward with their decisions. For example, when you apply for a credit card, your lender will take a look at your FICO score and understand how good you are at repaying your debt.

Along with time, FICO is updating the scoring model as well. As of now, you can find FICO score 9. However, most of the lenders are still using FICO score 8 for their calculation purposes.

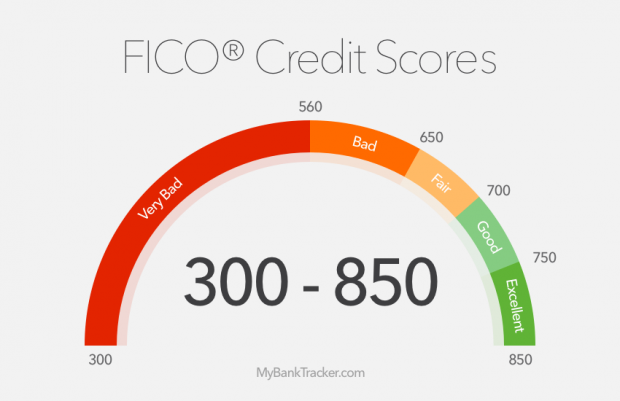

If your FICO score is 800 and above, you are having an excellent credit score. Scores between 740 and 799 are very good and a score between 670 and 739 will be good. A FICO score between 580 and 669 will be fair. People who have a poor credit score have less than 580 points according to the FICO scale.

Now you have a clear understanding of what credit score and FICO score are. FICO is just a brand of credit score and you should never assume that both of them are the same.