Exploring Industrial Real Estate Investment Trusts (REITs) and Their Potential Growth

Industrial real estate investment trusts (REITs) are gaining momentum as manufacturing and logistics companies opt to lease rather than own their properties. This shift is opening up opportunities for industrial REITs to expand their portfolios and drive growth in the sector.

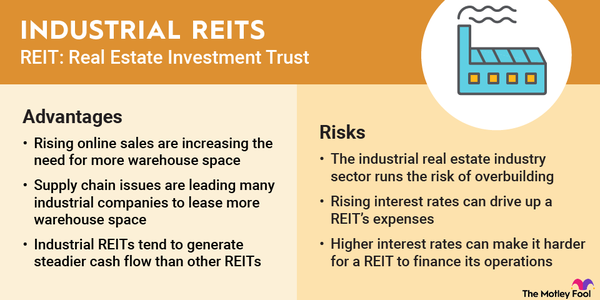

Industrial companies require specialized real estate for their operations, including light manufacturing facilities, warehouses, and flex/office spaces. Industrial REITs lease these properties to tenants under long-term contracts, providing them with steady cash flow. The sector has seen significant demand drivers, such as the rise in online sales and supply chain issues, leading to increased occupancy and rental rates.

However, investing in industrial REITs comes with risks, including the potential for overbuilding and exposure to interest rate fluctuations. Despite these risks, industrial REITs offer advantages like steady cash flow and growth opportunities driven by demand tailwinds.

For investors looking to capitalize on the industrial REIT sector, here are five industrial REITs worth considering:

1. Prologis: A global leader in logistics real estate with a focus on long-term growth and a diversified portfolio.

2. Americold Realty Trust: The only pure-play REIT on cold storage properties, with a focus on food manufacturers and distributors.

3. STAG Industrial: A diversified industrial REIT with a focus on single-tenant properties and a monthly dividend payout.

4. Innovative Industrial Properties: Specializing in properties leased to state-licensed cannabis operators, providing capital to the cannabis sector.

5. PS Business Parks: Owning properties in top U.S. markets, primarily multi-tenant industrial, flex, and office spaces, with a focus on smaller businesses.

Overall, industrial REITs offer investors a unique opportunity to capitalize on the growing demand for industrial real estate. With a focus on long-term leases and steady cash flow, industrial REITs present a compelling investment option in the real estate sector.